You all must know about the Flipkart App. we use it for shopping. However, friends, you may not know about a new feature of this app, with which we can easily take a personal loan of up to 5 lakhs.

Friends, I understand that you may have several questions about how to take a loan from the Flipkart App, what the application process is, how long it takes for the loan to be available, what documents are required, who is eligible for this loan, what the interest rate is, and more. I assure you, I will address all of these queries in this blog post. By the end of it, you will feel confident and comfortable about taking a loan from Flipkart.

Table of Contents

Documents required to apply for loan from Flipkart

To take a loan from Flipkart, you have to submit the documents online only; you do not have to submit them offline.

- Aadhar card

- Pan card

- Selfie image

- Bank account proof

5 benefits of taking a personal loan from Flipkart

- Instant Approval: One of the most reassuring aspects of Flipkart’s personal loan service is the instant approval feature. You can apply for end-to-end digital personal loans of up to ₹5 lakhs, and your loan will be approved within 30 seconds directly on the Flipkart platform.

- Flexible Repayment Options: The personal loan service provides flexible repayment cycles ranging from 6 to 36 months. This means you can choose a tenure that suits your financial situation and repayment capacity. The EMI is automatically deducted from your bank account monthly, making it convenient and hassle-free.

- Competitive Interest Rates: Flipkart’s loans come with competitive interest rates, which are designed to enhance affordability for borrowers and provide a sense of financial security.

- Increased Purchasing Power: Flipkart customers can enhance their purchasing power and address various financial needs, such as education, travel, medical emergencies, or home renovations, by accessing personal loans. This means you can fulfill your needs and aspirations without having to wait or compromise on your plans.

- Digital Convenience: The entire process is digitally enabled, making it convenient and efficient for customers.

This strategic partnership between Flipkart and Axis Bank aims to simplify customer journeys and empower users with financial solutions that cater to their evolving demands. Axis Bank, a trusted financial institution, is the lending partner for Flipkart’s personal loans, ensuring the credibility and reliability of the loan process.

How to apply Flipkart Personal Loan in an easy way

Friends, now let me guide you through the loan application process. It’s a simple and straightforward process that you can complete in a few easy steps. Just follow what I am telling you, and you’ll be able to apply for a loan from Flipkart in no time.

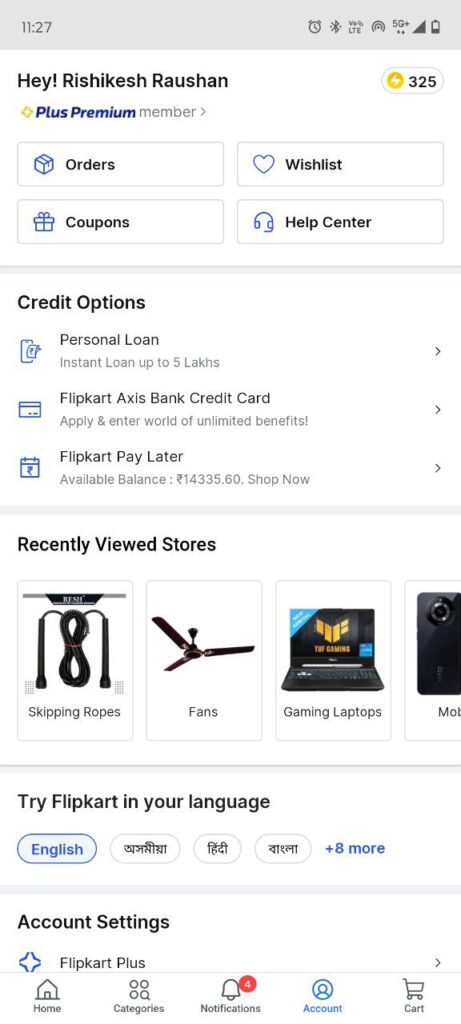

Install the Flipkart App: If you’re an existing Flipkart customer, you likely already have the Flipkart app on your smartphone.

- Access the Personal Loan Section: Find the “Personal Loan” section within your account.

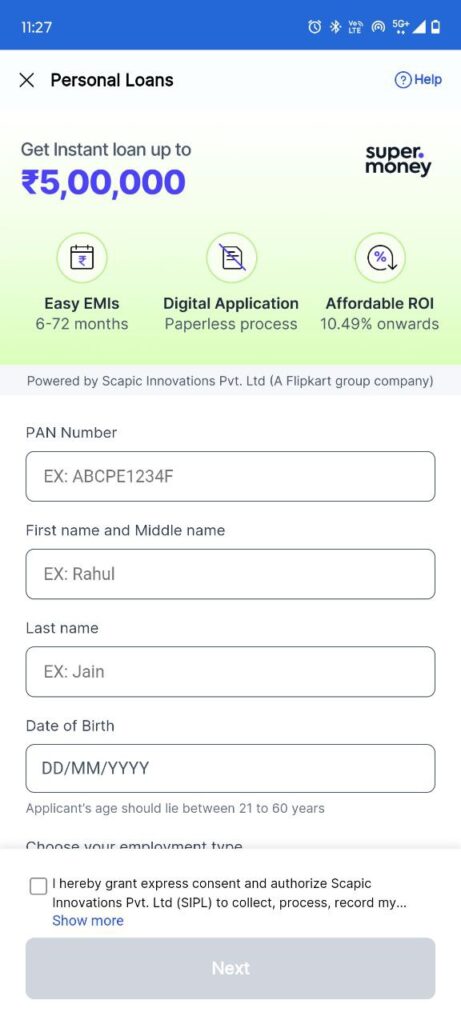

- Fill Necessary Details:

- Enter your date of birth, gender, and PAN card number.

- Choose your occupation (salaried or self-employed).

- View Your Loan Offer: After completing the above steps, you can view the loan offer. Remember that you need a higher credit score to qualify for a Flipkart loan.

- Remember, the entire process is digitally enabled, making it convenient and efficient for customers. You can contact Axis Bank’s customer care if you have any further queries.

What are the eligibility criteria for this loan?

Before taking a loan from the Flipkart App, you must read these eligibility criteria. If you fulfill these criteria, then only apply for the loan.

- Indian Residential Status: You must be an Indian resident.

- Existing Flipkart Customer: You should be an old Flipkart customer.

- Good Credit Score: A credit score of 720 or higher is often crucial for deciding eligibility.

- Mobile Number Linked with Aadhaar Card: Ensure your mobile number is linked to your Aadhaar card.

- Age Range: Applicants typically must be between 21 and 55 years old.

- Minimum Monthly Income: Lenders usually set a minimum income threshold (around ₹15,000) to ensure borrowers have a stable financial standing to meet repayment obligations.

Interest rate

| Loan Amount (₹) | Tenure (Month) | Interest Rate (%) |

|---|---|---|

| 50,000 | 12 | 10.49 |

| 1,00,000 | 24 | 12.99 |

| 2,00,000 | 36 | 15.49 |

| 3,00,000 | 48 | 17.99 |

| 5,00,000 | 60 | 20.49 |

Fee and charges

| Fee/Charge | Description |

|---|---|

| Processing Fee | Typically a percentage of the loan amount (e.g., 1% to 2%). Charged at loan approval. |

| Late Payment Fee | Charged for missed EMI payments. |

Flipkart Personal Loan Helpline No

Friends, you may face problems or questions when you apply for a loan. For this, you can talk to Flipkart’s customer care.

Customer Care Number: 1860-419-5555/1860-500-5555. Calling this number will answer all your loan-related queries.

FAQ

Q: What is the maximum loan amount I can get through Flipkart Personal Loans?

A: The maximum loan amount available through Flipkart Personal Loans is ₹5 lakhs. However, the actual amount you qualify for depends on your creditworthiness and other factors. ‘Creditworthiness’ refers to your ability to repay the loan based on your past financial behavior, such as your credit score, income, and existing debts. The higher your creditworthiness, the more likely you are to qualify for a higher loan amount

Q: Can I prepay my Flipkart Personal Loan?

A: Yes, you can prepay your loan.

Q: What happens if you miss EMI payment?

A: If you miss an EMI payment, a late payment fee will be charged. Making timely payments is crucial to avoid penalties and maintain a good credit history.

Q: Can I apply for a personal loan if I’m self-employed?

A: Yes, self-employed individuals can apply for Flipkart Personal Loans. Please ensure that you meet the eligibility criteria, provide all the necessary documents (such as income proof), and follow the application process.

Q: Can students apply for a Flipkart loan?

A: While specific eligibility criteria may vary, students must meet certain income and age requirements to apply for a Flipkart Personal Loan. It’s advisable to check the detailed terms and conditions on the Flipkart platform or through Axis Bank

Should we take a personal loan from Flipkart?

Friends, you should take a loan from Flipkart only when you have an emergency because if you take a loan from a bank, it will take several weeks, but you will get the loan at a low-interest rate. If we talk about Flipkart, you will get the loan in 30 seconds, but the interest rate will be a little high. Now, friends, you have to consider whether to take a loan from Flipkart or not.